Charitable nonprofits frequently think they need to register to solicit donations in all 50 states. I’ve got some good news for you – fortunately not all states require this.

Charitable nonprofits frequently think they need to register to solicit donations in all 50 states. I’ve got some good news for you – fortunately not all states require this.

The number of states that do require charitable solicitation registration varies in some circumstances, usually depending on the type of organization, and sometimes you’ll find conflicting information when searching for the exact states where this is required.

Let’s clarify which states require charitable solicitation registration for most charities, along with a few notable exceptions.

States That Require Charitable Solicitation Registration and Renewal

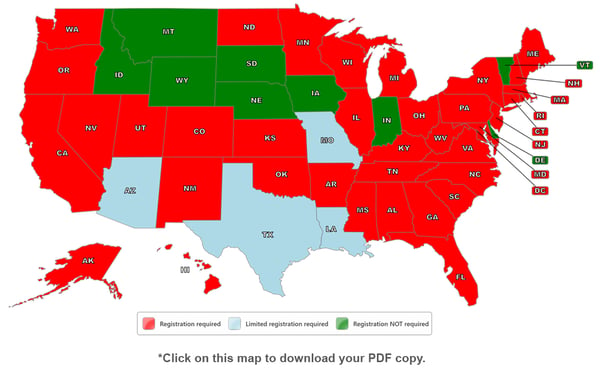

Currently, 37 states and D.C. broadly require charitable solicitation registration and renewal, unless a specific exemption applies. Exemptions vary greatly in each state, but most exempt religious organizations like churches and synagogues, and many exempt hospitals and educational institutions (e.g. colleges, universities).

However, there are frequently exceptions to the exemptions, and thus, a careful reading of each state’s requirements is needed. If you work with a house of worship or education/healthcare‑oriented organization, our complimentary CREW platform can help you navigate through each state’s requirements.

States That Do NOT Require Charitable Solicitation Registration

There are 9 states that do not require charitable registration for nonprofits:

|

|

There are a few states that only require registration if a nonprofit is engaged in specific activities or seeks assistance from professional fundraisers. For example, Texas has limited registration requirements that are only applicable to law enforcement, public safety and veterans organizations. Arizona requires charitable veterans organizations to register if they are soliciting money or other support in the state. Louisiana only requires registration if a charity engages paid, professional solicitors to fundraise in their state, while Missouri exempts 501(c)(3), 501(c)(7) and 501(c)(8) organizations, upon application.

Charitable Registration is NOT Qualification to Do Business

Keep in mind that registering to solicit in a state is not the same as filing for a business license or qualifying to transact business in a state. With few exceptions, this is not required when a charity’s only nexus or connection with a state is fundraising via phone, email, direct mail or online.

To sum it up as neatly as possible, if a 501(c)(3) charity soliciting nationwide is not a law enforcement, public safety or veterans organization, does not use the services of a professional solicitor and is not otherwise in an exempt category, that nonprofit would be required to register in 37 states and D.C. – and file a one-time exemption in Missouri.

Not sure how to handle the registrations in those 37 states? The good news is that you don't have to go it alone. Put our expertise to work for you.

This content is provided for informational purposes only and should not be considered, or relied upon, as legal advice.