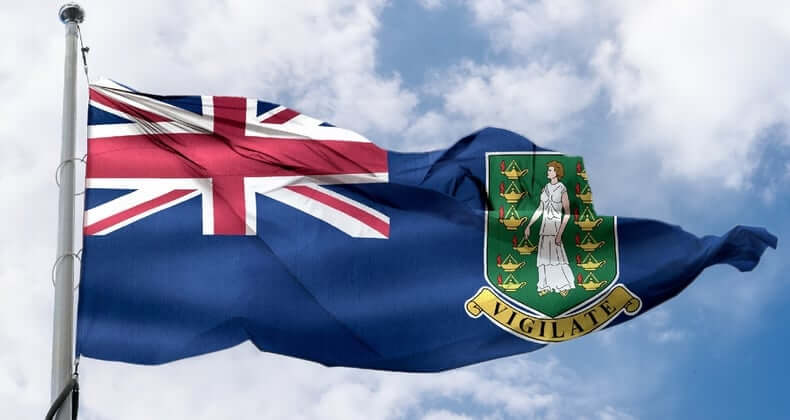

New Filing Requirements for Beneficial Ownership Information in British Virgin Islands

New beneficial ownership filing requirements in the British Virgin Islands (BVI) take effect on January 2, 2025. Learn what these changes mean, who’s impacted, and how to stay compliant under the updated regulations.

What This Is: The British Virgin Islands (BVI) has introduced new requirements mandating certain entities to file beneficial ownership information with the BVI Financial Services Commission.

What This Means: Entities operating in the BVI must now comply with these filing obligations to ensure transparency and adherence to regulatory standards. Read on for more info in our article below.

Introduction

It’s been almost ten years since the release of the Panama Papers and we’ve seen significant legislative changes to combat the abuse / misuse of legal entities, like companies and trusts. Enhanced beneficial ownership transparency is a primary objective of these legislative changes as it helps to expose anonymously owned companies that are often used as escape channels for criminals. Beneficial ownership transparency is essential to prevent, detect, prosecute, and sanction financial crimes like fraud, money laundering, and tax evasion.

The British Virgin Islands (BVI) is a leading hub for financial services and is often referred to as a “tax haven”. However, over the last decade, the government of BVI has taken steps toward a fairer tax system, and now BVI’s regime is ahead of many ‘onshore’ jurisdictions. As such, BVI has introduced new requirements in relation to beneficial ownership information effective January 2, 2025. There is now a statutory obligation for all BVI companies and limited partnerships, whether regulated or unregulated, to comply. This new regulation is designed to enhance financial integrity and align with international anti-money laundering (AML) standards. Being aware, and understanding these new requirements is essential for companies in the BVI.

Understanding Beneficial Ownership

A beneficial owner is any natural person who ultimately owns or controls a legal entity, and is defined as:

- in the case of a legal person (other than a listed company), a natural person who:

- ultimately owns or controls, directly or indirectly, 10% or more of the shares or voting rights in the legal person.

- holds, directly or indirectly, the right to appoint or remove a majority of the board of directors of the legal person; or

- otherwise exercises control over the management of the legal person.

- in the case of a limited partnership, a natural person who:

- is ultimately entitled to or controls, directly or indirectly, 10% or more share of the capital or profits of the partnership or 10% or more voting rights in the partnership; or

- otherwise exercises control over the management of the partnership.

- in the case of a trust,

- the trustee.

- the settlor or other person by whom the trust is made.

- the protector (if any).

- the beneficiaries or class of beneficiaries with a vested interest in the trust at the time of or before distribution of any trust property or income; and

- any other natural person exercising ultimate effective control over the trust (including through a chain of control or ownership).

Entities Required to File Beneficial Ownership Information

Prior to January 2, 2025, filing BO information was an obligation of the registered agent of the company. However, under the new regulation, a company itself is now obligated to collect, keep, and maintain acceptable, accurate, and current beneficial ownership information. The registered agent will make the filing with the Registrar on behalf of the company upon verification of the beneficial ownership information. Any changes to the beneficial ownership information must also be filed with the Registrar and via the registered agent.

The filing requirements apply to various BVI entities, including:

- Companies limited by shares – Any natural person owning or controlling 10% or more of shares or voting rights.

- Companies limited by guarantee – Members exercising control through voting rights or board appointments.

- Limited partnerships (LPs) – General partners and any limited partners holding 10% or more in capital or profits.

- Trusts and legal arrangements – Trustees, settlors, protectors, beneficiaries with vested interests, and individuals with effective control.

The BOI register kept by the Registrar will not be public. It will only be accessible to:

- Competent authorities acting within their legal powers or handling matters under an enactment, including mutual legal assistance requests.

- Law enforcement agencies carrying out their lawful duties.

Some entities may be exempt from filing BO information, including:

- Companies listed on a recognized exchange

- Certain funds regulated under the Securities and Investment Business Act (SIBA)

- Subsidiaries where 75% or more is owned by another entity that has already complied with BO filing requirements

Even with exemptions, entities must notify the registrar and maintain internal BO records.

Simplify international business with a single point of contact. Explore our International Corporate Services today!

Filing Requirements and Deadlines

New legal entities: Must file BO information within 30 days of incorporation, registration, or continuation.

Existing entities: Have six months from the enforcement date of the BO Regulations to comply. Extensions of up to 21 days may be granted under exceptional circumstances.

Entities must provide detailed information about their beneficial owners, including:

- Full legal name (as it appears on official ID)

- Date and place of birth

- Gender

- Occupation

- Nationality

- Residential address

- Nature of ownership or control

For trusts, information on the trustee, settlor, protector, and beneficiaries must also be filed. However, licensed trustees under the Banks and Trust Companies Act (BTCA) need only file the trustee’s name.

Compliance Challenges and Common Pitfalls

Navigating the updated filing requirements can present significant compliance challenges for companies. With stricter regulations in place and steep penalties for non-compliance, it’s more important than ever to ensure proper identification and reporting of beneficial owners. Here are some pitfalls and obstacles you might face:

- Not knowing who the Beneficial Owners are or not being able to provide the required reporting information.

- Failing to identify the correct Beneficial Owners or not providing sufficient data regarding same.

- Not staying informed or not seeking professional assistance

Penalties for Non-Compliance

Failure to meet the BO Regulation filing obligations can lead to substantial penalties. The BO Regulations impose a four-tiered penalty system, with fines ranging from $10,000 to $75,000 depending on the severity and nature of the violation. Non-compliance affects not only the legal entity but also senior officers who permitted or agreed to the breach. It’s critical for entities to implement systems to monitor and update BO information regularly.

Next Steps

As with any new law, practices will develop over time. These changes will require technical updates to systems and software (for registered agents and regulators) which will be worked out over the next weeks and months.

If you have any questions in relation to these issues feel free to contact the International Team at Cogency Global at international@cogencyglobal.com

This article is provided for informational purposes only and should not be considered, or relied upon, as legal advice.

Leave Us A Comment

Did you find this article useful? We'd love to hear your thoughts. Join the conversation by leaving a comment or question below.