Avoiding Fatal Debtor Name Mistakes on UCC Financing Statements

Now on Demand: This webinar covered debtor name requirements, the Minor Error Rule, and best practices to avoid mistakes.

Webinar Details

The importance of the debtor name cannot be overstated when preparing and filing UCC financing statements. This webinar, titled Avoiding Fatal Debtor Name Mistakes on UCC Financing Statements, provides critical insights on how to avoid errors by reviewing important case law that puts on display the types of mistakes still being made since Amended Article 9 was enacted. We provide case examples followed by practical steps to avoid unwelcome UCC filing surprises.

Learning Objectives:

- Entity and individual debtor name requirements

- The Minor Error Rule

- Case law and what has gone wrong

- The 5-part fact pattern

- Model Administrative Rules (MARS) and search logic

- How to avoid debtor name mistakes

- Summary and conclusion

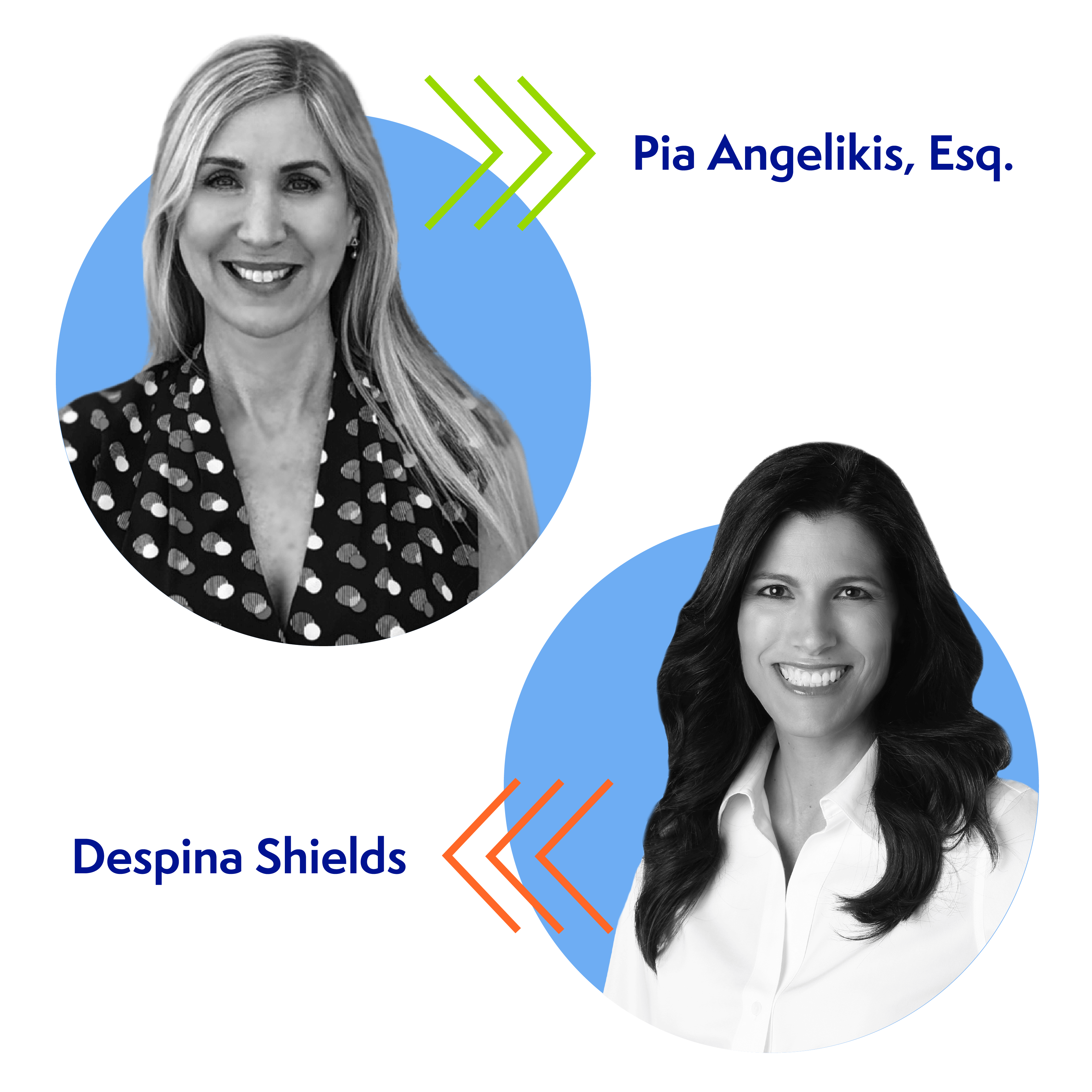

Meet the Hosts

Pia Angelikis, Esq.

Pia Angelikis, Esq., is the Vice President of Government Relations and Legal Research at Cogency Global Inc. She has over 20 years of experience with premiere service companies in the UCC and corporate services industry, managing large teams of expert lawyers and paralegals conducting legal research for public filing requirements for multistate mergers, conversions and acquisitions, tracking and analyzing UCC Article 9 and business entity legislation in all 50 states and the District of Columbia, and providing thought leadership. Prior to her career in the UCC and corporate services industry, Ms. Angelikis litigated for 5 years in the areas of insurance defense and employment law. She wrote the winning brief resulting in the 9th Circuit published opinion, In re Complaint of Ross Island Sand & Gravel, 226 F.3d 1015 (9th Cir. 2000). Ms. Angelikis holds a JD from the University of California, Hastings College of the Law and is licensed to practice law in California.

Despina Shields

Despina Shields is Vice President of UCC Product Management at Cogency Global Inc. Ms. Shields has extensive secured transactions experience and has been in the UCC service industry since 1988. She has provided Article 9 seminars for financial institutions, law firms and paralegal associations and has been a featured speaker on UCC issues for the Pittsburgh Paralegal Association, the National Public Records Research Association and the National Federation of Paralegal Associations (NFPA). Ms. Shields served on three Secured Transactions Section (STS) committees of the International Association of Commercial Administrators (IACA): The Search Logic Committee, Trademark Committee and Hip-Pocket Amendments (addressing bogus UCC filings) Committee. Ms. Shields knowledge of the conceptual framework of Article 9 combined with her practical experience ensures a valuable learning experience for those who attend her seminars.

CLE/MCLE Information

Is there a fee to attend this webinar?

There is no fee to attend our webinars, but advance registration is required

What states do you register for CLE Accreditation?

Currently, we apply for accreditation in California, New York, Florida, Illinois and Texas

Do you offer CLE accreditation for paralegals?

Some webinars are accredited through NFPA and NALA.

Do I have to attend the entire webinar?

To receive full credit, you must be present for the entire presentation and answer all poll questions throughout the webinar.

Who is this webinar suitable for?

Although anyone may attend the webinars, it is most suitable for newly admitted and experienced attorneys and legal professionals.

What happens if my state is not one of those listed previously?

For any states not listed as approved or pending, we strongly encourage attendees to self-apply/self-report to the respective states.

Does CLE accreditation for your webinars expire?

Please be aware that CLE accreditation does expire. We will post on the related pages when a webinar no longer qualifies for CLE credit. Check with your CLE/MCLE board in your state to be sure.

- New York: Three years after the date of the live event.

- Texas: Two years after the date of the live event.

- California: Two years after the date of the live event.

- Illinois: Two years after the date of the live event.

- Florida: 18 months after the date of the live event.