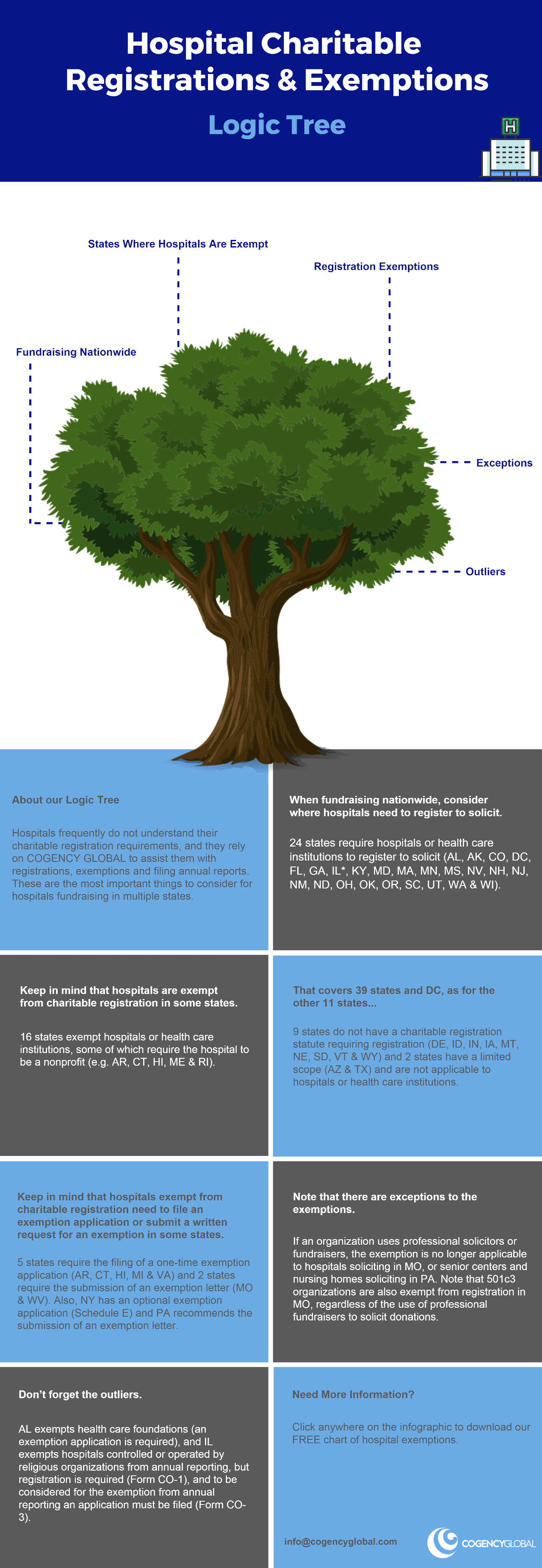

Charitable registration requirements and exemptions vary from state to state. When your nonprofit organization is involved with healthcare, the rules and regulations regarding fundraising compliance can differ even more.

For administrators of healthcare organizations that fundraise in multiple states, it’s challenging to determine whether and where you need to register and where your organization is exempt.

Which States Require Hospitals to Register?

In total, 24 states require hospitals or health care institutions to register to solicit:

|

|

There are some special exceptions in the states starred above. Alabama will exempt health care foundations, however, an exemption application is required. Illinois exempts hospitals controlled or operated by religious organizations from annual reporting, but charitable registration and an exemption application from annual reporting are required.

Which States Exempt Hospitals from Charitable Registration?

There are 16 states where hospitals and health care institutions are exempt from charitable solicitation registration, although some require the hospital to be a nonprofit (e.g. AR, CT, HI, ME, RI and VA).

While hospitals may be eligible for an exemption from state charitable registration, you may need to file an exemption application or submit a written request (letter) for the exemption:

|

|

Exceptions to the Exemptions

If only it were that simple – register in these states, apply for exemption in the others. As they say, “the devil is in the details”.

In a few states, there are exceptions that can negate an otherwise available exemption. For example, exemption is no longer applicable to hospitals soliciting in Missouri or senior centers and nursing homes soliciting in Pennsylvania if those health care organizations use professional solicitors or fundraisers.

What About the Other States?

You might notice that between required charitable solicitation and available exemptions, we’ve only covered 39 states (and District of Columbia). Nine states do not have a charitable registration statute requiring registration and two states* have regulations that are not applicable to hospitals or health care institutions.

In either case, registration is not required in these 11 states:

|

|

For more information on state requirements, download our chart on exemptions to charitable solicitation registration for hospitals, health care institutions and related entities.

This content is provided for informational purposes only and should not be considered, or relied upon, as legal advice.

Leave Us A Comment

Did you find this article useful? We'd love to hear your thoughts. Join the conversation by leaving a comment or question below.