What this is: When you’re managing the closing of a complex financing transaction like that of a commercial mortgage-backed security, a detail-oriented checklist is your best friend.

What this means: We’ll provide you a sample checklist and walk through some of the steps needed to create a useful and organized process for closings.

Checklists are used by so many people every day to manage tasks, both personal and professional. Atul Gawande, author of The Checklist Manifesto: How to Get Things Right, highlights the power of checklists as written guides that walk us through the key steps of any complex procedure or transaction. Doctors, pilots and attorneys have historically used detailed checklists to ensure that even the smallest action items are accounted for and that the responsible party is identified.

“Under conditions of complexity, not only are checklists a help, they are required for success” – Atul Gawande

Across my experience working at a law firm, in-house at a publicly traded company and now at a service company, checklists have long been integral in managing projects. As you can imagine, the quote above from Mr. Gawande resonates deeply with me, especially when it comes to closing checklists for transactions.

Why Use a Closing Checklist?

A closing checklist for a merger or commercial finance transaction can sometimes far exceed 20 pages. Working as a paralegal at a law firm or member of the legal team at a company, managing the items and documents on one of those massive closing checklists, I would clearly outline who was responsible for each item and note which resources/service providers I could rely on for completing or obtaining what I was responsible for, in advance of a closing.

The specificity and attention to detail that a checklist allows for can help ensure that the overarching legal transaction is carefully documented, and all actions are taken to protect the parties in the transaction. A missed UCC securities filing in a commercial real estate transaction, for example, could result in the loss of the priority interest in the collateral securing the lender in the transaction. Not ensuring that the company purchasing property is duly formed, qualified and active and in good standing in its state of formation and the state where the property is located well in advance of the closing date can result in an unwanted fire drill at the 11th hour. The consequences can be significant.

Get owner verification, mortgage searches and real estate documents without a costly title search.

Commercial Mortgage-Backed Securities Transactions

Part of my current role at Cogency Global is working on financing transactions for Commercial Mortgage-Backed Securities (CMBS). This type of security is secured by a loan on a commercial property. As a service company, we often assist clients with many items that are commonly found on a closing checklist for a CMBS transaction:

- Submit a Certificate of Formation to form a Delaware LLC as a single purpose entity (SPE) or bankruptcy remote entity (BRE) borrower

- Qualify newly formed SPEs/BREs in the state where the commercial property is located

- Act as independent manager for the transaction

- Act as agent for service of process (AKA process agent) under the terms of the loan/financing agreements in New York or other designated jurisdiction if required by lender and if needed under the governing law provisions

- Support public record filings and post-closing search for UCC filings

- Obtain certified charter documents and Good Standing Certificates

Typically, the attorneys and paralegals we work with note the date they communicate with us for any of these services and the status of the filing(s) or document(s) requested. These actions all feed back into their larger transaction checklist.

In addition, we are also often asked to provide process agent services under the governing law provision of the finance agreements. We are frequently appointed as process agent in the State of New York which is a preferred venue by lenders because of the deep understanding of sophisticated commercial financing transactions and vast legal precedents related to decisions in CMBS and other real estate-based transactions. For more information about the role of a process agent, please see Appointing a Process Agent: The Counterparty’s Perspective.

A Sample CMBS Transaction Checklist

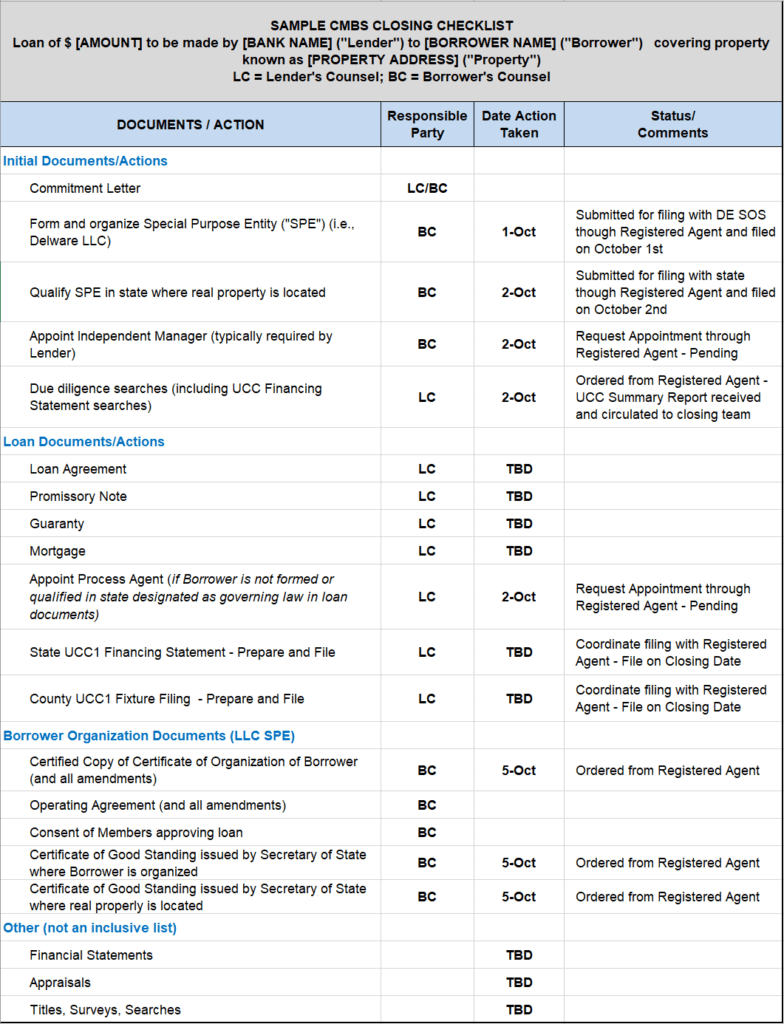

Below is a sample checklist highlighting some of the core actions typically found on a closing checklist for a CMBS transaction.

You’ll notice the sample checklist above includes columns designating which party is responsible for a line item, dates marking when an action was taken and a column with notes on an item’s present status. Together, these pieces of information help the closing team track what is happening, including those items covered by service companies.

Keep in mind, your closing checklist is a living document. Deadlines can change and additional documents or actions might be added as the CMBS transaction is negotiated. Closely managing and maintaining your closing checklist as these complex financing transactions proceed is an important key to a successful closing.

“Even Han and Chewie use a checklist” – Jon Stewart

Other Reads You Might Enjoy

What should I look for when appointing a process agent for a CMBS or REIT deal?

Time is always of the essence when closing on any large commercial financing transactions (so responsiveness, hands-down, ranks in first place). Sometimes, the cost of not closing or funding on time can be significant.

Whether you are contacting a potential process agent with the intent to close in a week, 24 hours or even that very afternoon, you need a professional process agent company that understands how critical a swift response is for meeting your closing date. How fast do they respond to your initial quote request? How quickly will they deliver a draft agreement or process agent appointment letter? These are questions that help ensure you receive acceptance documentation on time to satisfy the conditions of your operative agreements and the tasks on your closing checklist. For more on this, read our article Top 5 Qualities to Look For When Appointing a Process Agent.

Is the choice of law important in CMBS or REIT deals?

In certain commercial real estate transactions (e.g. REITs or CMBS deals) domestic to the US, New York is a common choice for the governing law of the loan and related agreements, even if the property is located in another US state. If the special purpose entity (SPE) purchasing the property is not registered or qualified to do business in New York, it can name a process agent in the loan agreement to fulfill the “minimum contacts” requirement to ensure it can be served in New York. Choice of governing law is typically a lender decision and/or requirement and, while New York is a common choice, other states for a variety of reasons can be designated.

This article is provided for informational purposes only and should not be considered, or relied upon, as legal advice.

Leave Us A Comment

Did you find this article useful? We'd love to hear your thoughts. Join the conversation by leaving a comment or question below.