What this is: There are still many questions regarding FinCEN and the Corporate Transparency Act. Our in-house thought leader, Pia Angelikis, Esq. tries to sort out some of the most important ones.

What this means: With the CTA ready for implementation on January 1, 2024, you might still wonder about some of the Act’s nuances. Let’s take a look at additional questions and answers surrounding the CTA.

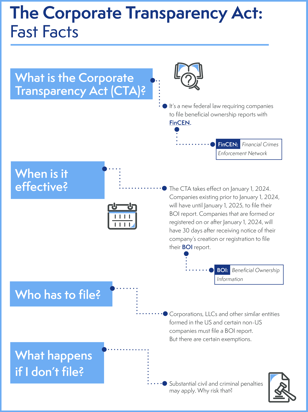

What is the Corporate Transparency Act?

The Corporate Transparency Act (CTA), a pivotal piece of legislation aimed at enhancing corporate transparency in the United States, is set to bring about significant changes for businesses beginning in 2024. This act, signed into law as part of the National Defense Authorization Act for Fiscal Year 2021, seeks to combat money laundering, tax evasion and other illicit financial activities by mandating the disclosure of Beneficial Ownership Information.

The Corporate Transparency Act (CTA), a pivotal piece of legislation aimed at enhancing corporate transparency in the United States, is set to bring about significant changes for businesses beginning in 2024. This act, signed into law as part of the National Defense Authorization Act for Fiscal Year 2021, seeks to combat money laundering, tax evasion and other illicit financial activities by mandating the disclosure of Beneficial Ownership Information.

Under the CTA, many businesses will be required to provide detailed information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN), an agency of the US Department of the Treasury. The stated intent of the CTA is to combat financial crimes and promote transparency.

Questions and Answers

1. What are law firms planning regarding “company applicants” and “FinCEN Identifiers”? Will they require their attorneys and paralegals to obtain FinCEN identifiers?

Law firms are at different stages of adapting to the CTA. Some have already established guidelines, while others are still in the decision-making process. The approach varies widely among firms.

2. Can a “Reporting Company” file one Beneficial Ownership Information (BOI) Report with FinCEN on behalf of itself and its subsidiaries?

Each entity defined as a nonexempt “reporting company” is required to file its own BOI report. The parent company cannot file one large report encompassing all subsidiaries.

If you still have questions, stop by our Corporate Transparency Act resource center and have a look around for informative articles, webinars and even a CTA Exemption wizard.

3. Can an LLC use its parent's EIN or does it need to obtain its own?

Each “reporting company” must use its own tax identification number and not its parent company’s.

4. How far up must you report if companies are owned by other companies?

“Beneficial owners” are individuals and not entities under the CTA. Therefore, unless exemptions apply, “reporting companies” owned by other “reporting companies” must provide information on each individual “beneficial owner."

5. Are “Company Applicants” responsible for submitting BOI Reports to FinCEN?

The “reporting company,” rather than its “company applicants,” is responsible for submitting its BOI report to FinCEN.

Other Resources

Understanding and complying with FinCEN identifier requirements is paramount for law firms and reporting companies. It is evident that adapting to the changing landscape of regulatory compliance is essential, with each entity being responsible for its own BOI Report and tax identification number. As these regulations continue to evolve, staying informed and proactive is key to ensuring legal and financial transparency in the modern business environment.

If you are interested in knowing more about what Cogency Global is doing with the Corporate Transparency Act, you can find more answers in our article, 10 Frequently Asked Questions About the Corporate Transparency Act. Additionally, you can stop by our webinar training center and catch up on Corporate Transparency Act updates hosted by our in-house CTA thought leaders.

This content is provided for informational purposes only and should not be considered, or relied upon, as legal advice.