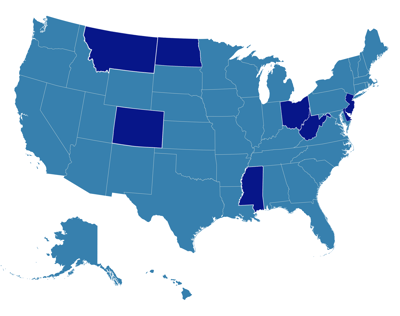

With the addition of Ohio at the end of January 2020, there are now eight states that only accept electronic UCC filings at the state level. (In North Dakota, this requirement applies to both state and county level filings.)

With the addition of Ohio at the end of January 2020, there are now eight states that only accept electronic UCC filings at the state level. (In North Dakota, this requirement applies to both state and county level filings.)

The digital revolution has – for the most part – made UCC filing easier, but there are some state‑specific requirements that must be taken into account to ensure your UCCs are accepted in these central filing offices.

Colorado Secretary of State

- The collateral field may not be left blank, even if an attachment is included.

- Collateral attachments are acceptable, up to a 10 MB file.

- The collateral description field is limited to a maximum of 1,000 characters, including spaces and punctuation.

- The Secretary of State does not accept public-finance transaction UCCs.

- UCC3 partial assignments are not accepted.

Delaware Secretary of State

- Each party address line is limited to 55 characters.

- City fields are limited to 22 characters.

- State field must be left blank for non-U.S. addresses.

- Optional filer reference field is limited to 50 characters.

- If an exhibit/attachment is added to the UCC, the state will automatically add the following text to the end of the collateral description provided by the filer: “Collateral Description – please see attached.”

- For UCC filers that opt not to file UCCs via the state’s online filing portal, or via XML filing systems like UCC ProFile, Delaware allows authorized service providers (like COGENCY GLOBAL) to access the state’s computer system and enter your UCC filing information into the state index.

Mississippi Secretary of State

- Exhibits/attachments not accepted.

- Only one UCC3 amendment type may be selected and submitted per filing.

- Real estate-related (fixture) filings are not supported.

Montana Secretary of State

- UCC addendums are not accepted.

- Only one UCC3 amendment type may be selected and submitted per filing.

- UCC3 partial assignments are not accepted.

- Real estate-related (fixture) filings are not supported.

- Optional filer field is limited to 80 characters.

New Jersey Department of the Treasury

- Each party address line is limited to 50 characters.

- All UCC filings must be made through the Division of Revenue and Enterprise Services (DORES) online filing portal.

- Transmitting utility (TU) filings are still accepted on paper since the state’s online portal will not allow for the TU designation.

North Dakota Secretary of State

- Social security numbers are required for all individual debtors on initial filings (UCC1s) and debtor amendments (UCC3s).

- Federal Tax ID numbers are required for all organization debtors on initial filings (UCC1s) and debtor amendments (UCC3s).

- Only one UCC3 amendment type may be selected and submitted per filing.

- Acceptable attachment formats are limited to PDF, JPG, or PNG files.

- When self-filing, acceptable forms of payment include a credit card or eCheck.

- The electronic-only UCC filing requirement also applies to county filings.

Ohio Secretary of State

- Optional filer reference fields are limited to eight characters.

- The postal code field is limited to five characters.

West Virginia Secretary of State

- Collateral description text must be 2,000 characters or less.

- PDF or TIFF attachments are acceptable but must be less than 2MB.

- No personal identifiable information (PII) can be included.

- Transmitting utility (TU) filings will still be accepted on paper, as the state’s online portal will not allow for the TU designation.

As of February 2020, only the eight states listed above require electronic UCC filings. However, we expect more states will follow suit in the near future.

This article is provided for informational purposes only and should not be considered, or relied upon, as legal advice.