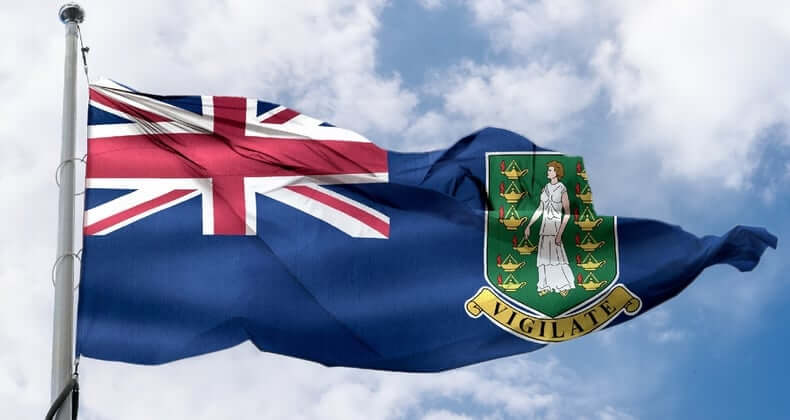

What this is: We continue with our series dedicated to beneficial ownership transparency worldwide (previously examining Hong Kong’s regulations and changes to UK law).

What this means: There are new Beneficial Ownership Requirements for the Cayman Islands, which became effective in March of 2018 and includes a new deadline for compliance – June 30, 2018.

Beneficial Ownership Regime

In March 2018, the Cayman government passed two laws outlining a new beneficial ownership regime, which we’ll continue referencing together as the ‘Amending Laws’.

- The Beneficial Ownership (Companies) (Amendment) Regulations, 2018

- The Beneficial Ownership (Limited Liability Companies) (Amendment) Regulations, 2018

These Amending Laws modify who must comply with the beneficial ownership regime, and impose new filing obligations on previously exempt companies. Consequently, all companies and limited liability companies (LLCs) registered in the Cayman Islands need to review their obligations under the new laws to ensure compliance by the deadline of June 30th, 2018.

Exemptions

The Cayman Islands beneficial ownership regime now requires all companies and LLCs to maintain a beneficial ownership register, unless they fall within any of the acceptable exemptions listed below.

Per Companies (Amendment) (No. 2) Law, 2017 and the Limited Liability Companies (Amendment) (No.3) Law, 2017, exemption from the new beneficial ownership regime may be granted to companies or subsidiaries of legal entities that meet at least one of the following criteria:

- Listed on the Cayman Islands Stock Exchange or an approved stock exchange.

- Registered or holding a license under a Cayman Islands regulatory law, other than a company registered as an excluded person under the Securities Investment Business Law (SIB Law).

- Managed, arranged, administered, operated, or promoted by an ‘approved person’ as a special purpose vehicle, private equity fund, collective investment scheme or investment fund, including where the vehicle, fund, or scheme is a Cayman Islands exempted limited partnership.

- Regulated in a jurisdiction whose anti-money laundering legislation is deemed by the Cayman Islands Anti-Money Laundering Steering Group to be equivalent to that of the Cayman Islands.1

- A general partner of a special purpose vehicle, private equity fund, collective investment scheme, or investment fund that is registered or holds a license under a regulatory law; or is managed, arranged, administered or promoted by an approved person.

- Directly holding a legal or beneficial interest in the shares of a legal entity which holds a license under the Banks and Trust Companies Law, the Companies Management Law, the Insurance Law, Part III of the Mutual Funds Law, or the SIB Law.

Even if your company is out of scope or exempt, you must provide your corporate service provider/registered agent in the Cayman Islands with written confirmation of your exempt status and why you believe you are exempt, to be filed with the Ministry of Financial Services. For companies falling within several exemptions, this written confirmation need only include the required information for one exemption.

Creating a Beneficial Ownership Register

If you cannot claim at least one of the exemptions listed in the Amending Laws, your entity is in scope and must create a beneficial ownership register.

A beneficial owner in the Cayman Islands is defined as an individual who meets one of these criteria:

- Holds more than 25% of the shares in the company, directly or indirectly.

- Holds more than 25% of the voting rights in the company, directly or indirectly.

- Holds the right, directly or indirectly, to appoint or remove a majority of the board of directors of the company.

Should no individual meet the conditions above, an individual is a beneficial owner of a company if they have the absolute and unconditional legal right to exercise, or actually exercises, significant influence or control over the company.

…all companies, whether in-scope or exempted, will need to take some action before June 30th, 2018…

Once your entity’s beneficial ownership register is assembled, your registered agent will upload the prescribed form into a search platform maintained by the Ministry of Financial Services in the Caymans. Registered agents are obliged to keep the beneficial ownership register updated no less than once a month.

The beneficial ownership search platform is secure and only accessible to competent authorities, such as those responsible for monitoring compliance with Cayman money laundering regulations or the Financial Crime Unit of the Cayman police force.

Non-Compliance Repercussions

Under the Amending Laws, all companies—whether in-scope or exempted—will need to take some action before June 30th, 2018 to be compliant.

Failure to comply with the legislation (such as not keeping a beneficial ownership register) can result in fines of CI$25,000 (US$30,000) for each offense and where the offense is ongoing, a fine of CI$500 (US$600) for each day or part of a day during which the offense continues to a maximum of an additional CI$25,000.

Restrictions notices may be sent to beneficial owners in the event of non-compliance, curtailing the rights of those registrable people to transfer shares (among other limitations) until proper actions are taken toward compliance.

Stay compliant with the Corporate Transparency Act. We’ll guide you through the requirements.

Beneficial owners who knowingly and willfully ignore a notice from a company or LLC, or knowingly or recklessly provide information which they know to be false, risk up to two year’s imprisonment and a fine of up to CI$10,000 (US$12,000).

Looking into a Crystal Ball

The beneficial ownership register in the Cayman Islands is not for public consumption, and only open for searches by competent authorities. However, this is likely to be a temporary position.

On May 1, 2018, the UK Government conceded an amendment to the UK Sanctions and Anti-Money Laundering Bill that will require British Overseas Territories, such as the Cayman Islands, to establish a publicly accessible register of beneficial ownership interests by the end of 2020. As an international corporate services provider, we monitor these requirements closely and will share substantial developments as they unfold.

This article is provided for informational purposes only and should not be considered, or relied upon, as legal advice.

Leave Us A Comment

Did you find this article useful? We'd love to hear your thoughts. Join the conversation by leaving a comment or question below.