I think many of us can relate to this quote: “Age doesn’t make you forgetful. Having way too many things you have to remember is what makes you forgetful!” Companies doing business in a number of states can attest to that. One thing that’s important for companies in multiple states to remember is to withdraw their company registration as a foreign entity if they are no longer doing business in a state.

While there can be valid reasons for maintaining a foreign registration, often the best course of action is to officially end the company’s foreign registration in a state by filing a Certificate of Withdrawal (sometimes called a Surrender of Authority). Until the Certificate of Withdrawal is filed, the company is still required to fulfill its annual obligations in the state where it is registered, such as filing informational reports and paying any taxes due.

Requirements for Withdrawing (Business Corporations and LLCs)

The process for withdrawal can vary depending on the state and the company type. In addition to completing and filing a Certificate of Withdrawal with the corporate registry, the following requirements apply:

- In most states, the company will need to be current in filing its annual reports with the Secretary of State or equivalent registry.

- Publication of the withdrawal is required in two states:

- Arizona requires a foreign corporation to publish the application for withdrawal within 60 days after the Arizona Corporation Commission approves the filing. No publication is required for LLCs.

- Pennsylvania requires foreign corporations to publish a notice of their intention to withdraw in a newspaper of general circulation in the county where the business was located and also in a legal newspaper in the same county. As in Arizona, this requirement does not apply to LLCs.

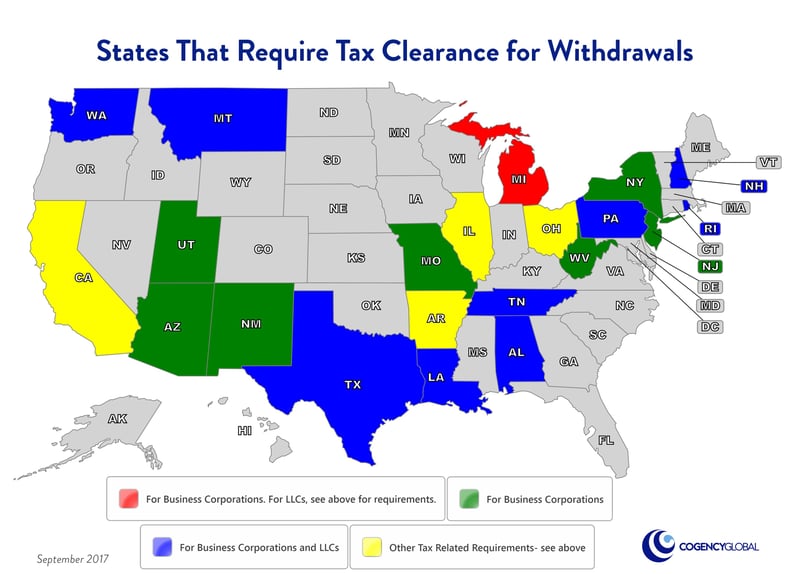

- The most common requirement for filing a Certificate of Withdrawal is tax clearance. There are a number of states which require clearance for different company types as shown in the map below. There are also states which don’t have tax clearance as a prerequisite but do have other tax requirements:

- Arkansas: Corporations and LLCs must file a final franchise tax return. Failure to do so may result in an entity’s inability to withdraw.

- California: Corporations and LLCs must include a statement indicating the final tax return has been or will be filed as required in the Certificate of Withdrawal.

- Illinois: If the Application for Withdrawal shows an increase in paid-in capital, a cumulative report must be filed and all applicable franchise taxes, penalties and interest due must be paid.

- Michigan: For LLCs, tax clearance is not a prerequisite but must be requested within 60 days after the withdrawal is submitted.

- Ohio: Corporations can either (1) submit an affidavit that states they have notified specific government agencies in writing of the scheduled date of filing the Certificate of Surrender and acknowledge that surrender does not release them from any taxes or contributions due or (2) they can submit clearances from those agencies.

The map below highlights which states require tax clearance for withdrawal.

Requirements like tax clearance and publication can make the process of withdrawal more complex and time consuming. A knowledgeable service company can help assist with this process. Please note however, that due to privacy concerns, there are certain tax departments that will only work with a direct representative of the entity. Although withdrawal can sometimes be complex, it is an important step worth remembering to ensure the company is not liable for taxes and other obligations when it no longer needs the foreign registration.

This article is provided for informational purposes only and should not be considered, or relied upon, as legal advice.