Tips for a Smooth M&A Closing Part 1: Closing Checklists

In this first article of our 3-part series, we will look at a general overview of considerations as you organize your closing checklist in the preliminary due diligence phase, when the parties to the deal have just agreed to the general terms of the M&A deal.

What this is: This article, the first in a 3-part series, provides an overview of key considerations for organizing your closing checklist during the preliminary due diligence phase, following the agreement on the general terms of an M&A deal.

What this means: Creating a detailed closing checklist is a crucial early step in ensuring a successful merger or acquisition. This checklist serves as a vital guide, outlining the necessary documents, required actions, responsible parties and deadlines for the deal to close successfully.

Over the years I have worked on many merger and acquisition (M&A) transactions in law firms and in companies. For new associates at law firms or new paralegals, it is helpful to understand some basic things up front when you will be working with your legal team preparing for an M&A transaction.

Part 1 Overview

In this first article of our 3-part series, we will look at a general overview of considerations as you organize your closing checklist in the preliminary due diligence phase, when the parties to the deal have just agreed to the general terms of the M&A deal. Part 2 will review practical tips to consider when you are conducting your public records due diligence and coordinating your state filings, including some real-life examples of issues that can arise and how to prevent them. Part 3 will discuss the important steps that should be taken post-closing and consequences of not handling certain post-closing items.

Closing Checklist Basics

Generally, drafting a comprehensive closing checklist is one of the first important steps to ensure a successful merger or acquisition. The closing becomes an important guide for all parties working on the deal listing the documents to be drafted, actions to be taken, responsible parties and deadlines to be managed and met in order to close the deal. The closing checklist will include conditional precedent “CPs” meaning items and actions that must be completed before the merger or acquisition deal closing on a specified date.

The closing checklist also helps all parties involved manage the various phases of the deal and key administrative items on the closing checklist that often get left to the last minute and may cause undue stress and fire drills at critical times before closing.

Streamline your merger and conversion filings nationwide with our proactive coordination.

Importance of Tracking and Coordinating Timing

Often times a closing checklist for an M&A deal will contain key areas commonly considered as part of a buyer’s and seller’s legal due diligence investigation to ensure that there is full disclosure of all material items outlined in the Merger or Purchase Agreement (e.g., financial and legal representations, ensuring that the target company and related subsidiaries exist and are in good standing) that support legal opinions that will be delivered at closing.

As a junior attorney or paralegal, it is important to track and coordinate timing related to obtaining Good Standing Certificates, ensuring that you know what annual report due dates may be coming due between the early due diligence phase and your closing date to ensure companies do not fall out of good standing, requesting comprehensive UCC and lien searches, reviewing any business licensing requirements to assign to the buyer as early as possible in advance of closing, preparing to form your acquisition company and preparing and pre-clearing the Certificate of Merger. For all of these items, understanding the difference in timing and requirements to complete each in each state is critical and can help you avoid unwanted delays.

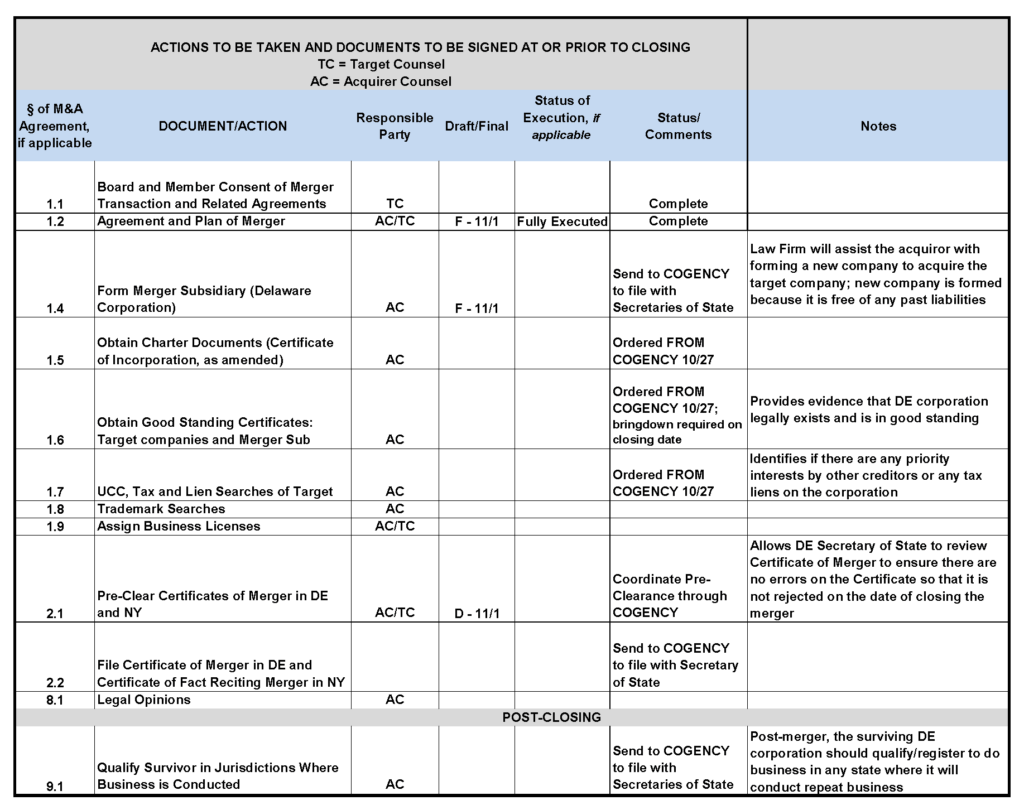

Sample Closing Checklist

Below is an excerpt of a sample closing checklist including just a sampling of items that will be required to be completed. Reviewing the sections you will be responsible for and adding specific notes regarding timing considerations will allow this checklist to be utilized as a valuable tool to ensure you have all of your bases covered during each phase of the M&A transaction.

In Part 2 of this series, we will review suggested action steps you can take as you conduct your due diligence and public record searches and filings along with tips on notes you may want to add to your closing checklist to ensure it serves as the most valuable tracking tool possible.

Other Reads You Might Enjoy

What is one reason that it’s important to update the public record post-merger?

It is Legally Required. Most states have statutes that require foreign companies registered to do business in their state to update the public record when they undergo a change due to amendment, conversion or merger. For example, Section 372(c) of Delaware’s General Corporation Law states: “Whenever a foreign corporation authorized to transact business in this State ceases to exist because of a statutory merger or consolidation, it shall comply with §381 of this title.” Section 381 outlines the procedures for withdrawal for foreign corporations. Want to read more? Head on over to our article, Updating the Public Record: The Importance of Post-Merger Cleanup.

What is an example of an item on the closing checklist that must be completed?

Obtain Good Standing Certificates. Acquirer wants to ensure that the target is “duly existing, in good standing and has paid its franchise taxes” through the date of the closing.

The purchase or merger agreement typically provides the number of days prior to closing that the Good Standing Certificates should be dated; the goal is to get this as close to closing as possible and as a belts-and-suspenders measure, getting a verbal bringdown on the date of closing. To learn more, read our companion article, Tips for a Smooth M&A Closing Part 2: Due Diligence and Filings.

What is an example of a post-closing task that needs to be addressed following a merger or acquisition?

In addition to your domestic state, identify all of the states/jurisdictions where the surviving company has plans to do business. These jurisdictions may not be the same as they were before the merger. If there are any changes, proceed with qualifying the survivor in new states and withdrawing them from states where the company will no longer be active. Keep in mind that the requirements and timeframes can vary greatly from state to state. Check out the third installment of our blog series, Tips for a Smooth M&A Closing Part 3: Post-Closing Matters.

This article is provided for informational purposes only and should not be considered, or relied upon, as legal advice.

Leave Us A Comment

Did you find this article useful? We'd love to hear your thoughts. Join the conversation by leaving a comment or question below.