What this is: Under Texas law, most charities and nonprofit organizations that are soliciting charitable donations from Texas donors are not required to register to solicit. Unlike most states, Texas has three solicitation acts that require charitable solicitation registration and renewal filings: the Law Enforcement Telephone Solicitation Act (LETSA), the Public Safety Solicitation Act (PSSA) and the Veterans Solicitation Act (VSA)

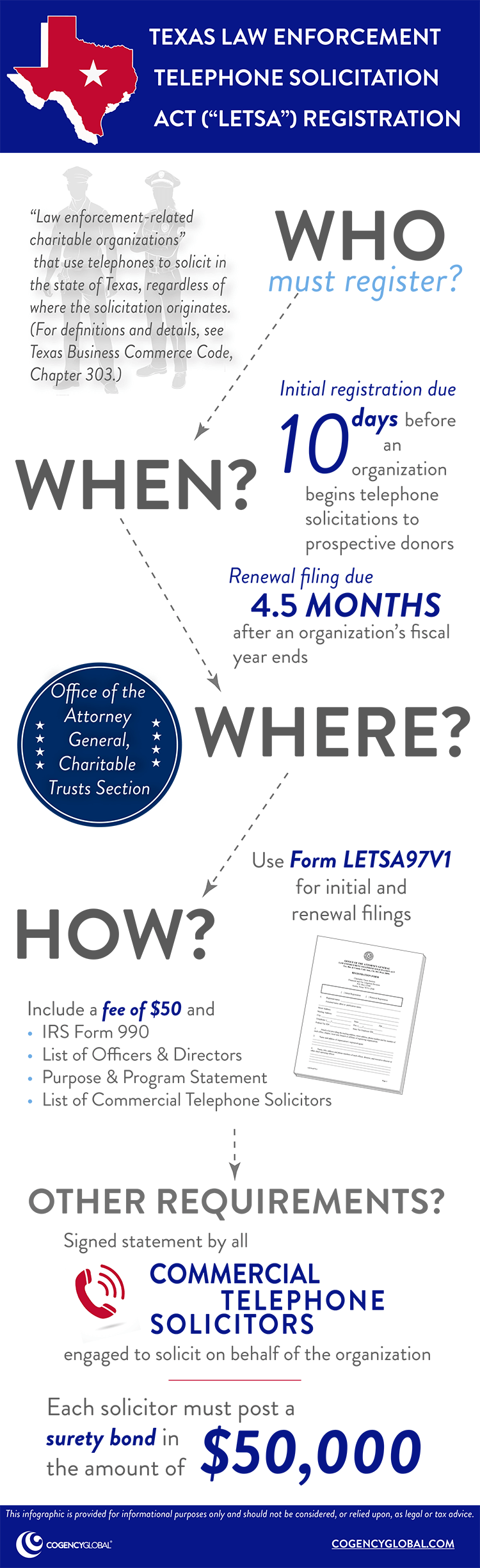

What this means: The Texas Secretary of State is the filing agency for documents required by the PSSA and VSA, and the Texas Office of the Attorney General is the filing office for registration filings required by LETSA. Below, you’ll find our infographic that highlights what you need to know about LETSA registration.

Similar infographics are also available for Soliciting Charitable Donations in Texas, Part Two: PSSA adn Soliciting Charitable Donations in Texas, Part Three: VSA.

Additional information, forms, and FAQs can be found here: LETSA, PSSA, and VSA.

Our dedicated team stands out, trusted by diverse nonprofits for professional support.

This article is provided for informational purposes only and should not be considered, or relied upon, as legal advice.

Leave Us A Comment

Did you find this article useful? We'd love to hear your thoughts. Join the conversation by leaving a comment or question below.

I volunteer with a 501c3, and I’m in charge of the online fundraising campaign which is a walkathon. I have my own business which facilitates the fundraising campaign. Am I allowed to charge the non profit for my services by invoicing them? Also, should we receive donations outside the state of Texas, are there special registrations that we have to file to receive out of state online donations?

Of course you can charge the nonprofit for your services, but you should consider taking a look at your state’s charitable solicitation statute(s) before doing so. Depending on the type of charity (e.g. veterans organization), and the type of work you are doing, there might be charitable registration requirements for the charity and you. As for donations received from outside of Texas, if the contributions are unsolicited, then registration in other states is likely not required. However, if the donation was made in response to a solicitation, then registration is required. As for online donations, if you have an interactive website that allows for online donations, then Florida requires registration, and depending on the amount and number of donations, registration might be required in Colorado, Mississippi, and Tennessee. You should review the Charleston Principles to assist you in making a determination in other states. Note that the following states do not require charitable registration: DE, IA, ID, IN, MT, NE, SD, VT & WY. Also, Arizona and Texas have limited registration requirement that are not applicable to most charities. Louisiana only requires registration if you engage paid, professional solicitors to fundraise in that state, while Missouri exempts 501c3 organizations after submitting a one-time exemption request. To assist you further, please review two of our prior blog posts: Strategies to Limit State Charitable Solicitation Registrations, and Does Our ‘Donate Now’ Button Require Charitable Registration?. Also, this video might be helpful: Does Having A “Donate Now” Button On A Website Mean You Have To Register In Every State? There are many variables that affect what the proper course of action is for your specific situation, so the information we are providing here cannot be taken as legal or tax advice. For a definitive answer, your best bet is to consult with legal counsel and/or a tax professional.