What this is: Since the Delaware Limited Liability Company Act was amended in 2018 to allow for the division of an LLC, only 57 Certificates of Division have been filed with the Delaware Secretary of State.

What this means: LLC division can offer entities a greater level of flexibility in reorganization. However, as a relatively new option in Delaware, there are many questions about the requirements and how it’s accomplished.

LLC Division: How Does it Work?

Division of an LLC essentially works like a merger in reverse.

First, an LLC drafts a ‘plan of division’ which lays out the terms and conditions for allocating its assets, property, rights, debts, liabilities and duties to the resulting LLCs. Division allows an LLC to split off separate lines of business, assets or holdings, where each newly created LLC ends up with a portion of the assets and liabilities of the original LLC. Once the plan of division is in place, a Certificate of Division is filed along with Certificates of Formation for the resulting LLCs that are outlined in the plan.

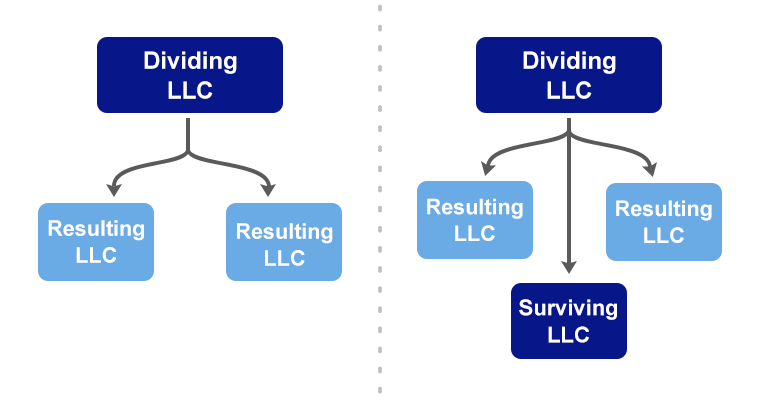

There are essentially two options for dividing an LLC. The major difference is whether or not the the original LLC – or ‘dividing LLC’ – survives after filing the Certificate of Division.

In the first example on the left, where an LLC divides into two or more resulting LLCs and the dividing LLC ceases to exist, the original LLC does not need to wind up its affairs or file a Certificate of Cancellation. Once the Certificate of Division is filed and the resulting companies have been allocated, the original LLC ceases to exist.

Creating a Plan of Division

The division process is governed by the plan of division, much in the same way a merger is governed by a merger plan. The plan of division lays out the following details:

- The terms and conditions for the exchange or conversion of LLC interests.

- The allocation of assets, property, rights, debts, liabilities and duties.

- Any necessary amendments to the dividing LLC’s operating agreement.

- The agreements for the newly formed resulting LLCs.

- The appointment of a Division Contact, who will have custody of a copy of the plan of division. (For a period of 6 years, the Division Contact must provide to any creditor the name and address of the division company where the creditor’s claim was allocated by the plan of division.)

Unless otherwise spelled out in the operating agreement, the plan of division must be approved by 50% or more of the LLC’s members.

Filing a Certificate of Division

Once the plan of division is in place, the next step in the division process is to file a Certificate of Division, which essentially works like a Certificate of Merger in reverse. The Certificate of Division must be filed simultaneously with the Certificates of Formation for the new LLCs (as outlined in the plan of division) and must include the following provisions:

- The name of the dividing company.

- Whether the dividing LLC will survive the division.

- The dividing company’s formation date.

- The name of each division company.

- The name and business address of the division contact.

- A statement that the plan is approved, on file with one of the division companies and will be provided upon request.

- A future effective date can be included, if desired.

Upon the effective date of the Certificate of Division and accompanying formations, all the rights, privileges and powers, as well as all the property liability and debts allocated to the resulting LLC by the division plan, are “allocated to and vested in the applicable division company” as prescribed in DE LLCA Section 18-217(I)(2). The newly formed division companies, per Section 18-217 (I)(3), will then “be liable as a separate and distinct domestic limited liability company for such debts, liabilities and duties of the dividing company as are allocated to such division company”.

Avoid LLC Division Filing Rejection

Beyond some of the more common reasons that can lead to filing rejection, there are few things to be mindful of with respect to LLC division. Before filing a Certificate of Division, double-check for the following issues:

- Incorrect information provided on the dividing LLC. (For example, the name or date of formation does not match what appears on Delaware’s records.)

- The section of law referenced is incorrect. (For reference, it’s Section 18-217 of the Delaware Limited Liability Company Act.)

- Improper Execution. (Was it signed by one or more authorized persons?)

- The Certificate of Division is not accompanied by Certificates of Formation for each entity resulting from the division.

Are you considering an LLC division? Do you have additional questions about the process?

Streamline your merger and conversion filings nationwide with Cogency Global’s proactive coordination.

This content is provided for informational purposes only and should not be considered, or relied upon, as legal advice.

Leave Us A Comment

Did you find this article useful? We'd love to hear your thoughts. Join the conversation by leaving a comment or question below.