What this is: Involuntary dissolution is likely to happen if a company is not aware of or doesn’t manage its obligations correctly, but there are ways to avoid it. And there are consequences if you don’t.

What this means: Not making your statutory filings? Not keeping your entities in order? Not submitting required franchise tax returns? You may face involuntary dissolution by the Secretary of State or similar filing office.

What is Involuntary Dissolution?

Involuntary dissolution is a legal process where a company is forced to dissolve due to non-compliance with regulatory requirements. As a result, the company can face fines and penalties and may have difficulty obtaining financing or maintaining a lawsuit until the issue is resolved.

A quick review of almost any Secretary of State’s business entity database will reveal a number of revoked or voided entities that have been inactivated by action of the state, instead of the filing of dissolution or withdrawal documents by the entity.

The reasons for revocation of an entity are usually related to the failure of an entity to make a statutorily required filing, often because of poor entity housekeeping.

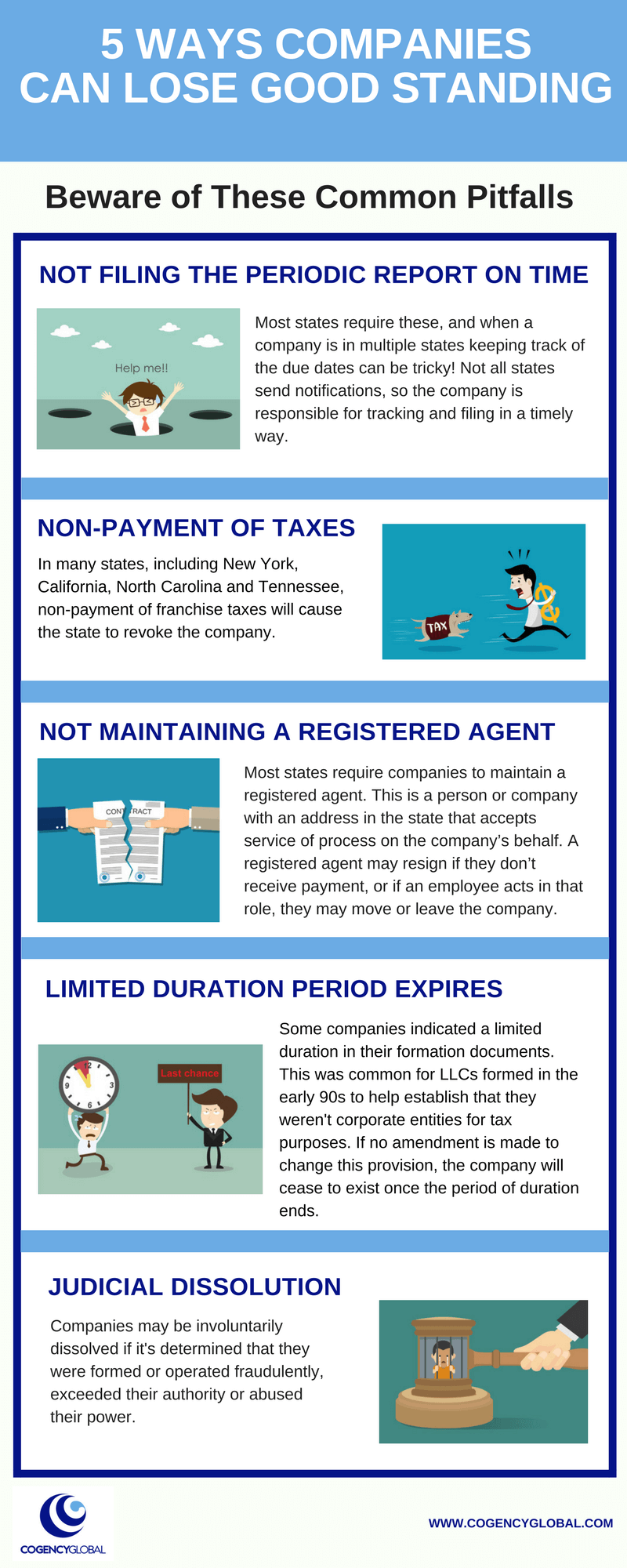

Three Main Reasons for Revocation Are:

- Failure to file an annual/biennial report with the Secretary of State. This is probably the most common reason for a business entity to be revoked. In some states it is possible for an entity to be revoked relatively quickly after missing a filing deadline. For example, Missouri may commence proceedings to revoke a foreign corporation for failure to file its report within 30 days after the

due date. At the other extreme, Connecticut does not have a provision for revoking a domestic corporation for failure to file a report. - Failure of the entity to file required tax returns or pay state taxes with the state tax department. In many states, this will not lead to revocation, but in some states, including California, Missouri, New Jersey and New York, failure to file tax returns and/or pay state taxes could result in revocation.

- Failure of an entity to maintain a registered agent and/or office. This typically occurs when the entity’s agent resigns for non-payment of its annual fees or some other reason and the entity fails to promptly appoint a new agent.

Sometimes a business will make an intentional decision to simply stop maintaining a foreign registration or domestic subsidiary, as it no longer serves the purpose of the business. At other times, the withdrawal or dissolution process may just be overlooked in the day-to-day rush.

| Need expert support for corporate filings, dissolutions and more? Visit our Corporate Services page. |

Consequences of Allowing an Entity to Go Void

Whatever the reason, the decision to allow a company to go void can lead to some admittedly rare, but serious consequences, including:

- The fact that the entity was not properly dissolved or withdrawn may turn up during the due diligence process for bank loans or contracts. These may then be delayed while the entity rectifies the issue.

- Taxes continue to accrue in many states and will need to be paid in order to formally withdraw or dissolve at a later date.

- The entity remains vulnerable to lawsuits and may have difficulty bringing a counter-suit due to the revocation.

- Corporate identity theft: Fraudsters have been reinstating revoked entities and using them for illicit purposes. The perpetrators count on the strong possibility that the owners are no longer monitoring the entity and they obtain control of an entity that appears to have been in existence for a number of years to facilitate their fraud.

These potential negative consequences of permitting a company to go void mean that an entity that is a going concern would be wise to meet all annual/periodic and tax filing deadlines. Additionally, the owners of entities that are no longer active can reduce their risks by properly dissolving and withdrawing the company in the states where it was formed and qualified.

Other Reads You Might Enjoy

How can you prevent an involuntary dissolution?

Ensure you are meeting your annual report and tax filing requirements. This will allow the company to maintain “good standing” status. Entities that are not in good standing may not be able to qualify to do business in another state or file certificates of amendment, merger or dissolution in some states, among other potentially damaging restrictions. Read more about it in our article Keeping Business Entities in Good Standing.

Also ensure you remit any annual renewal invoices to maintain your registered agent. The appointed registered agent could resign for non-payment which could lead to involuntary dissolution in states that require a registered agent.

How does involuntary dissolution differ from voluntary dissolution?

Involuntary dissolution is the result of an administrative action taken by the filing office or tax administrator in a state. The company is generally notified of the impending dissolution and after a specified period of time is marked inactive on the filing offices records. Voluntary dissolution is initiated by the company itself, which will take steps similar to those listed below which summarize the process for a Delaware corporation.

- Approval of the Dissolution: The Board of Directors must first draft and approve a resolution to dissolve and then call a meeting of shareholders for the specific purpose of approving the resolution. For a Delaware corporation, a majority of the voting shares must consent to the dissolution; in other states, a super majority may be required.

- Filing the Certificate of Dissolution: The next step in the process is to file the Certificate of Dissolution, which is a fairly simple document.

- Winding up: After a Certificate of Dissolution is filed in Delaware, the company continues for 3 years to give it time to wind up its affairs. During this period, the company can settle any suits against them, discharge any liabilities, distribute assets to shareholders and, if desired, provide notice to claimants, establishing procedures and time frames for establishing a claim. During the winding-up period, the company must also terminate its authority to do business in any state where it is registered as a foreign corporation.

For a more extensive explanation of the dissolution process, please check out this article, Life of a Company, Part 3: Dissolution and Winding up.

Is the Certificate of Dissolution the only filing to be made in all states?

In some states you’ll need additional consents, such as labor or tax department approval, before you can file your withdrawal or dissolution. Find out how we can help here.

This article is provided for informational purposes only and should not be considered, or relied upon, as legal advice.

Leave Us A Comment

Did you find this article useful? We'd love to hear your thoughts. Join the conversation by leaving a comment or question below.